Author: Christal Moura

embrace the wait

Jan. 25, 23 | Homeowners

Waiting, /ˈweɪtɪŋ / noun; the action of staying where one is or delaying action until a particular time or event.

We wait all the time, we wait in lines, we wait on hold, we wait for a prognosis, we wait for the next season of Grey’s Anatomy to come out, there are millions of reasons why we wait. Which is why I find it so hard to believe that very few people talk about how waiting is an inevitable component when it comes to buying or selling real estate.

In real estate we hear a lot about the fundamentals of a transaction, but rarely do we hear about how emotional the process can be and how those emotions can be magnified just by the simple introduction of time.

For example, imagine you just found your dream home and are over the moon excited about it, to the point you have already thought about which way your bed will face in the primary bedroom. You decide to submit an offer with a heart felt note attached to the seller explaining how much you love their home in hopes that they will choose your offer. You feel like you put your best foot forward and your agent sends it off and you wait eagerly in anticipation.

You feel like you put your best foot forward and your agent sends it off and you wait eagerly in anticipation.

You go from feeling elated and hopeful, but as every minute passes without a word back from the seller, you begin an inner dialogue in your head scrutinizing what you forgot to put in the letter, or maybe the closing date you put down wasn’t what they were looking for, so doubt creeps in and the joy seeps out every second that goes by. Finally, there’s thirty minutes left before the offer you sent expires, and worry and uncertainty consume you, until finally your agent has an update. In the span of just a few hours, you have been on a rollercoaster of emotions you never would have thought you would have and no one every told you about, and this is just one example of so many more.

I share this with you because as important as it is to know about the buying and selling process, or what the term bully offer means, it is also very important to hear about the emotional side of real estate. It’s not called “real” estate for no reason, this is real life and we all have real emotions. It’s for that reason and that reason alone that I love my job, because even though there can be frustrations or anxious thoughts during the buying and selling process, more times than not, I get to see the BIG happy and joyful emotions. My clients invite me into a chapter of their life to help them get to the next best chapter that is waiting to be written and there’s nothing sweeter than that.

So, in closing I will leave you with these parting words should you find yourself in the stillness of waiting, “embrace the wait, trust the process and believe that the outcome is exactly where you are meant to be.”

Cheers to a New Year and a Fresh Start

Jan. 13, 23 | Market Updates

The great thing about time, is that when you look back you have this unique advantage of being able to see the things you were present for but now with this glorious ability to reflect with a new perspective, all while still being able to recall what it was like being in that moment. So, when I look back at 2022, I have this new perspective that is entirely different than the one I would have shared with you had I been asked in that moment what my thoughts were.

You see, we entered 2022 with vivid memories from the previous year that had a profound impact on us all, and whether you realize it or not, how you spent your time, money, and talents this past year was directly influenced by what came the prior year.

We started 2022 still feeling deeply overwhelmed by the pandemic, and with a new Omicron variant on the scene. There was a partial lockdown at the time that lasted until mid February and by March 21st the mask mandate was lifted and by the end of April all directives were dropped.

Also, last March began the first of several Bank of Canada rate hikes which were the result of an increasing inflation rate which became note worthy in late 2021 when it was in the 4% range, but by June 2022 the inflation rate nearly doubled topping out at 8.13%. These rate hikes had a profound impact on the housing market, and as restrictions were a thing of the past, people seized every opportunity to connect with old family and friends and go places, they had been lusting about over the last two years, it was finally time. So, as people got busy being busy, the housing market that started out strong fizzled as the year went by.

In January 2022, the average sale price for a single detached home was just over one million dollars, or to be precise $1,094,707. By the end of the year the average dropped nearly 28% to the high 700,000s.

All data from ITSO, InfoSparks © 2023 ShowingTim

In January 2022, the average sale price for a single detached home was just over one million dollars, or to be precise $1,094,707. I heard a client share a sweet statement when he said “I never thought I would be living in a million-dollar home” because at the time prices were beyond every economist’s expectation and he was living in a modest and average home.

If you were selling your home during the first two months of the year, you were one of the last to benefit from the outrageous high in the housing market. But, as the interest rates started to be announced and one after another getting a little bleaker and dimmer, Buyer’s eagerness waned, and Sellers were no longer seeing those high-priced offers. In fact, not only were sellers not seeing those high prices they began to see the comeback of conditions in offers. With less competition in the market, buyers began including financing and home inspection conditions, in part because they could, but more importantly because it was prudent to do so with a market in such flux.

By the end of 2022, the same house that would have sold in less than a week for over a million dollars in Cambridge was now likely to sell roughly 28% less, closer to the high 700s and would take almost a month to do so. Usually, you ring in the new year with a bang, but for the housing market things seemed dismal. But, before you become all Debbie-downer on me, let me offer you some good news. Consistently, year over year for the last five years, house prices have continued to appreciate, i.e. go up in value. So, despite a dismal end to 2022, when we have the perspective of time to factor into our understanding, we now can see a brighter future.

House prices increased 6% in Cambridge which is a strong and healthy appreciation percentage.

All data from ITSO, InfoSparks © 2023 ShowingTime

As we look to 2023, having a clean slate, all we can do it predict what the year ahead holds and believe how you feel about that prediction will greatly influence how you see the year playing out.

So, if you’re like me, and like to see the glass as being half full, rather then half empty, let’s going 2023, thinking that it will be even better than the last year.

There’s no better time then the present to take the first leap of faith into a new year, and one step closer to your dream. If you’re dreaming about buying or selling real estate and you’re wanting to talk more, let’s get together over coffee. I would be so happy to have a coffee and even more excited to chat with you all about it what I love and how I can help you.

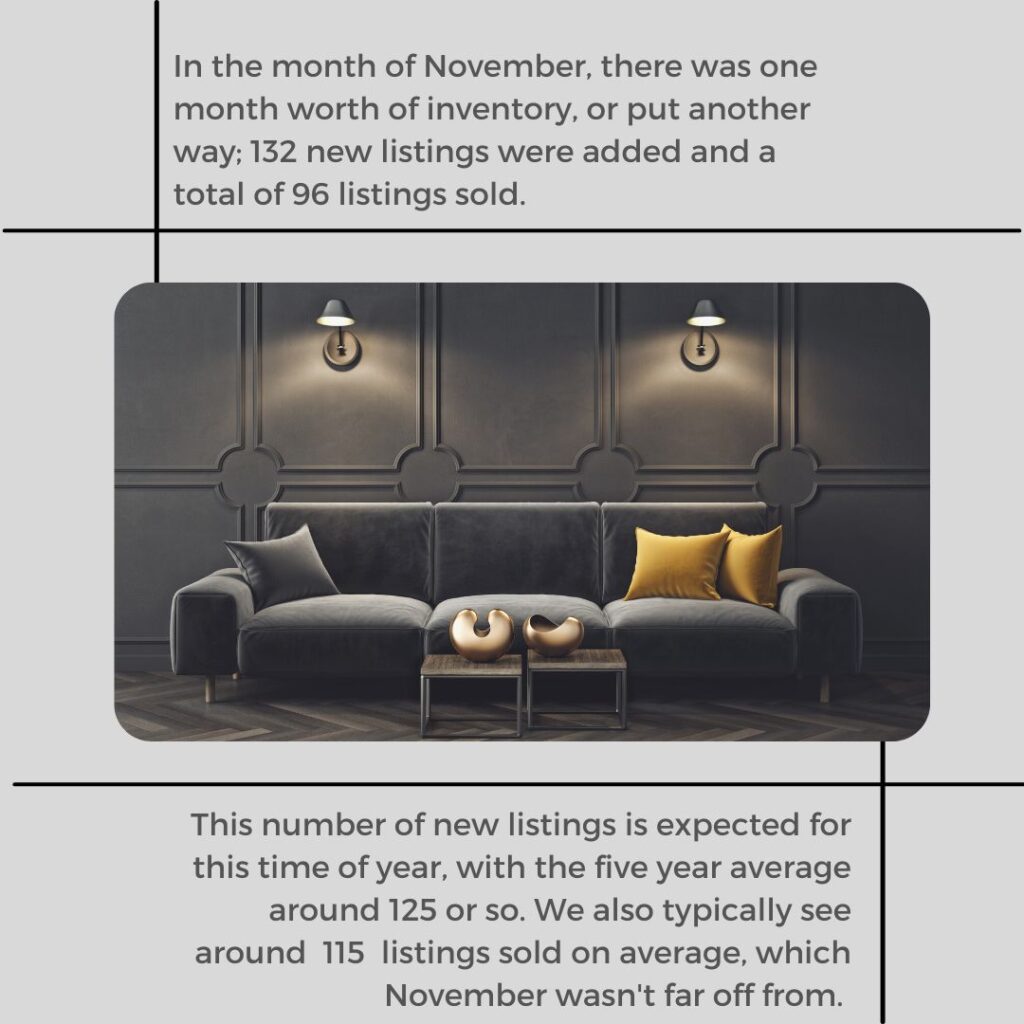

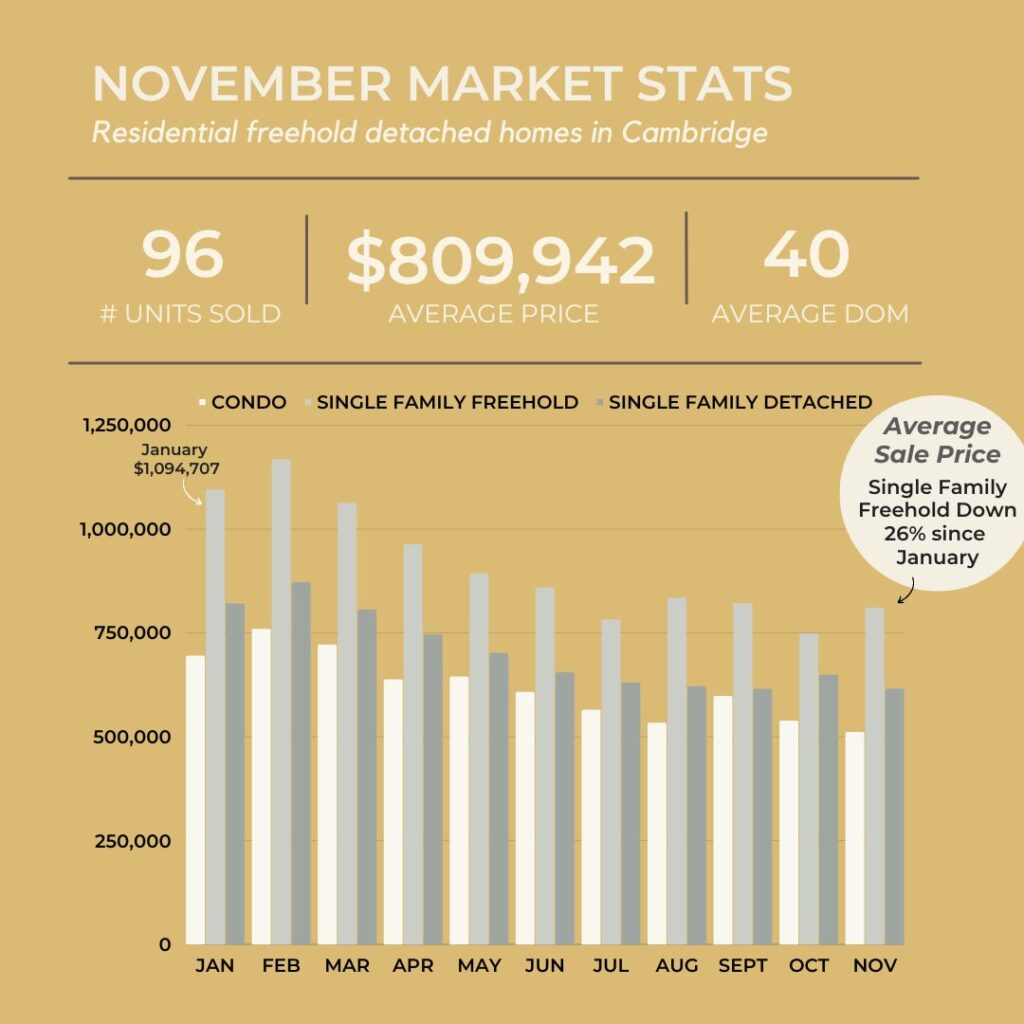

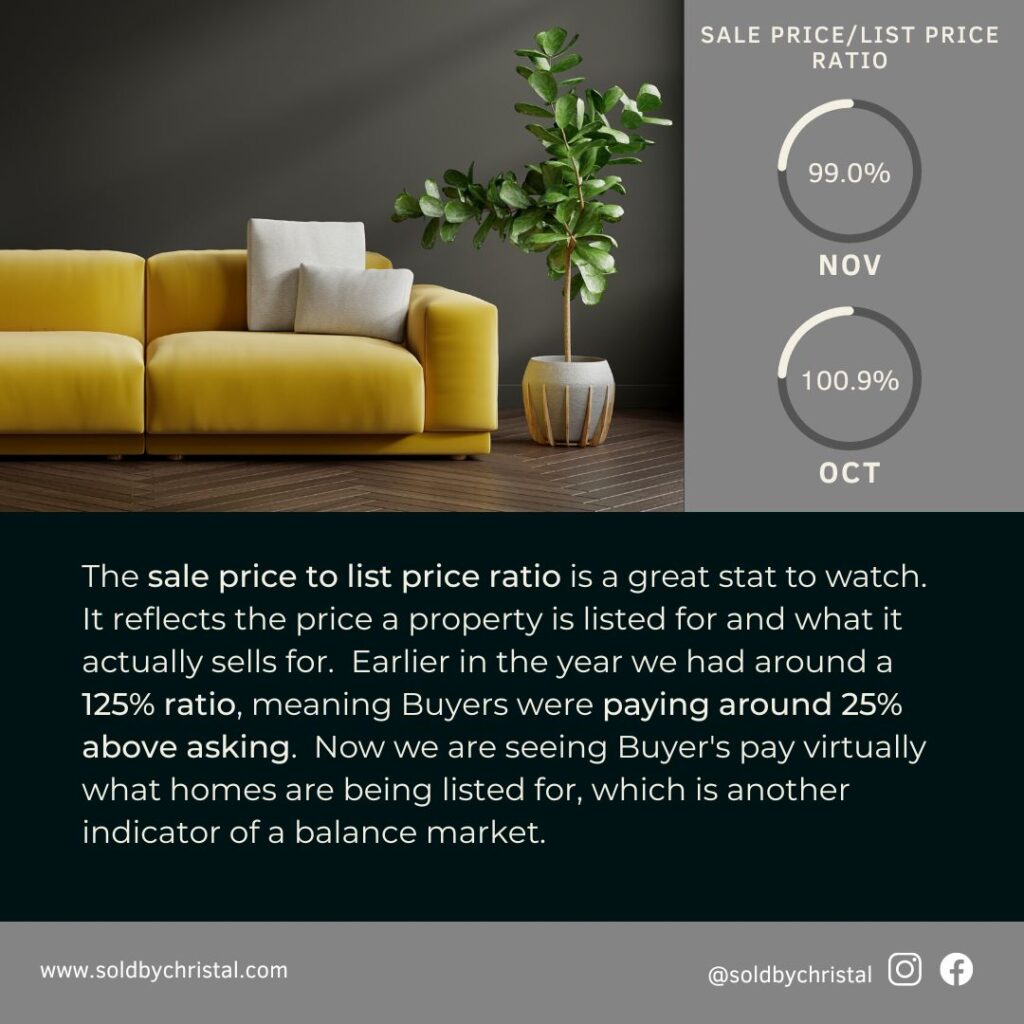

Market Snaphot – November 2022

Dec. 09, 22 | Market Updates

If I didn’t know that I was looking at the November 2022 stats, I would have thought it was November 2019. Reason I say that, is that the market is coming back to a more balanced state like we saw prior to COVID. Unfortunately, the boom of the housing market these past few years has clouded our memories of what a “normal” housing market looks like. We are so used to low interest rate, high demand and even higher sales prices, that we have forgotten about how a healthy and stable, or dare I say normal housing market looks like.

Sure we saw another hike to interest rates that continued to slow down buyers, but these increases to the prime rate that the Bank of Canada is making is having the exact effect that they are hoping to achieve, and that is to reduce inflation. It’s no surprise that the higher interest rates have definitely slowed down the intensity of the market, but it hasn’t stopped it completely. Remember, there will always be situations where people have to buy and/or sell, such as a job relocation, outgrowing their home, marriages or divorces. There are a variety of life circumstances that we just can’t avoid; delay, yes, but avoid not forever.

Inventory was low in November, with a total of 132 new listings in the City of Cambridge added and there were 96 total sales. This equates to roughly one month of inventory, or also know as MSI (month supply of inventory), which reflects the relationship between supply and demand. So, looking at November theoretically it would take one month to burn through all the homes currently available, so if no new listings were added, Buyers would be left without any options. The interesting element to note about the number of new listings and sales, is that these totals look very similar to what a five year average would have looked like prior to COVID. An average amount of new listings would have been around 125, and 115 sales, so in actuality, November 2022 is very healthy and balanced.

What may not be similar to the five year average prior to COVID, is the sale prices. In fact, the sale price for a single family detached home in November isn’t even remotely close to what is what at the beginning of the year. In January of 2022, the average sale price was sitting just above one million dollars ($1,094,707) and now eleven months later, that same house would sell for 26% less, closer to $800,000 and it would take over a month to sell, whereas in January it would have been about a week to two weeks.

Since there are fewer Buyers due to the rising interest rates and speculated economic uncertainty, demand has dropped. Houses that are being listed are selling closer to their asking value, and there is a smarter pace at which a Buyer takes to purchase a property. We have time once again to have finance and inspection conditions in our offers, which affords the Buyer the ability to make sure that the purchase that they are about to make is right for them. They can truly crunch the numbers, investigate all possible scenarios that they could encounter if yet another rate increase, or if they have a to replace an expensive aspect for their home unexpectedly.

Sure, the housing market these past two years made for better headlines in the news, but a more balanced market is more fair for both parties. Now is a great time to buy or sell, and if your curious to hear more, or discuss how I can help you with your real estate needs, whether buying, selling or investing I would be happy to have a coffee and chat with you all about it.

Top Ten Tips To Prepare Your Home for Winter

Nov. 28, 22 | Homeowners

With winter right around the corner, now is the time to make sure your home is ready while the weather is still nice. It’s only a matter of time before we see specs of white glistening snow fall from the sky, and don’t say I didn’t warn. So, in an effort to tackle your “Honey Do List” I am breaking down the top ten tips to help you prepare your home for winter this year. I reached out to local companies to get their tips, so if you have any questions about any of this, I have included links so you can reach out to them directly.

Top Ten Tips

- Test run your heating system – if you haven’t already fired up the furnace to find out, now is the time to try. You don’t want to have sub zero temperatures and cold house to get you to turn on the furnace only to find out it’s not working. So, test run that puppy to see that it’s in tip, top, shape. And while you’re at, consider cleaning or replacing your furnace filters, which should be done on a regular anyway.

- Install a Programmable Thermostat – If you don’t already have one, a programmable thermostat is a wise investment for any home owner. It may cost you a marginal price to invest in the thermostat, but it will pay for itself in the long run. Most home owners benefit from saving about 1% or more on their heating bill just by lowering the temperature by one degree or more.

- Winterize your Air Conditioning System – With winter comes harsh weather conditions that can cause severe damage to your A/C. Cold weather, now and ice could cause a number of problems so it is vital to the longevity of your unit to properly prepare it for those cold winter months. It doesn’t take too much work just a little time but it may seem like a trivial task but it will help you when you need it to work the best in those blazing hot summer days.

- Inspect the roof and clean the gutters – Remove any debris and clutter that has built up in the eave trough so that you can prevent ice blockages which can cause snow and water runoff to drain toward the foundation of the house.

- Invest in a Car Starter – The average person no longer has room in their garage for their vehicle because it functions more like a storage locker, which means you are parking your car outdoors. It’s not so bad in the warmer months, but on cold, icy and snowy days the thought of scraping the snow and ice off your car and then getting in and waiting for everything to warm up add a lot of added time to your busy schedule which feels tighter then normal with less daylight hours. Invest in an automatic car starter so you can start your car from inside while you drink your coffee before heading off to work.

- Stock Up on Windshield Washer Fluid – The snow might come down white and fluffy, but with all the cars sloshing through your windows will build up dirt and salt debris which requires more windshield washer fluid to rinse it away than summer months.

- Winterize Your Sprinkler System and Pipes – Water expands when it freezes and this can be hazardous for your pipes, because they could freeze and burst. One way to prepare your pipes for winter is to inspect them for cracks and then insulate. The pipes outside your home, such as garden hoses or sprinklers can be disconnected and turned off.

- Feed and Maintenance Your Lawn – By taking the time in the fall to winterize your lawn, you will benefit in the spring by paving the way for lush, healthy spring grass. You will need to know what type of grass you have and then fertilize with the right product so that the grass can respond to the external triggers to start the process of preparing for winter, and although the temperatures drop, plant roots remain active in soil so be sure to prep accordingly.

- Point Drain Pipes Away – As mentioned above you should make sure your gutters are clear of debris so they can drain properly, but also make sure that you down spouts point away from the house down a slight slope. If water collects near your home’s foundation you could compromise the structural integrity which could lead to expensive repairs.

- Get Draft Guards – If you have air leaks in around your doors, you are literally throwing money into thin air. Door hinges, under-door spaces, broken window seals, power outlets, and other wall fittings are common areas where you might be letting out air which is costing you more money to maintain a consistent temperature in the home. Consider installing draft guards that slide in under your doors and windows, sealing them up so that no air can come in from outside. Weatherstripping is another helpful trick to seal spaces like nooks and crannies that cannot otherwise be insulated.

BONUS TIP – while you have the ladder out, why not hang up your Christmas lights, you will be thankful you did later.

Each home is unique and each home deserves the care and attention required to help you maintain and keep things running smoothly so you’re not spending money on avoidable and costly fixes. Take the time to think of all the things that you should do and set aside the time to do them. It may require a little work upfront, but it will be worth it in the long run.

If you want to chat and discuss other ways to help keep your house in tip top shape and ensure that you are retaining and adding to your property value, I would love to do so over a cup of coffee. Contact me by filling out the contact information box below and I will be sure to get back to you.

Market Snapshot – October 2022

Nov. 04, 22 | Market Updates

October shaped up to be an extraordinary month because the looming news of the Bank of Canada’s decision to address the over night rate escalated Buyer’s motivation and timeline to purchase before they could be impacted yet again. On Oct 26th the BoC, did announce a .75 rate increase to the overnight rate, bringing interest rates to 3.75 per cent for the first time since 2008. If you recall what happened in 2008, we saw a massive hit to our real estate market as the dominos fell from south of the border only for our housing market to also be impacted. That recession took nearly 6 years to bounce back from and then the pendulum shifted to a new extreme that we saw at the height in 2016-2017. Just when we thought that housing prices couldn’t go any higher than the average year over year growth, COVID hit the scene which initially raised caution and concern for our industry.

However, within a few months, the market responded positively, thanks in part to the all time low interest rates and additional funding from our feds, allowing Buyers more equity and capital to invest in their current houses or leverage the opportunity and sell and reinvest in something that seemed unattainable any other time. Fast forward to June or July of this year, and we saw a dramatic halt due to the Bank of Canada’s interaction into the ever-high inflation. Seeing that it was quickly escalating and needing immediate attention, the government intervened and promised to tackle the surmounting problem and set a goal of hitting 2% by 2024.

Since government intervention, consumers are beginning to feel and adjust their spending accordingly. This has impacted the housing market, however, in our region we have still a healthy market with plenty of Buyers and an average stock of inventory. Typically, we would see around 200 single family detached homes on the market, but in October this year we had 161 which means we are slightly below inventory, but not nearly as below as we were in October of 2021, which only had 57 homes listed. Furthermore, in the month of October there were reported 82 sales, which is one of the lowest month of the year, second to January which had 64 sales. The average for the month of October should be somewhere between 100-150 in our market.

If we look at single family detached homes for Cambridge, we are noticing that it is taking longer then what we have been used to in order to sell a home. The average Seller should anticipate 4 weeks on the market right now which is also inline with a typical healthy market. The sale price also continues to drop from a staggering high, but as we have been seeing over the last few months that decrease is marginal and some semblance of consistency seems to be on the horizon. In January the average single family detached home sold for almost 1.1 Million dollars, however, this past month that same Seller should anticipate a lower number as the average sale price has dropped 32% to $748,005.

In summary, the City of Cambridge, is still considered a healthy market irrespective of what the media or some may perceive. Consumers need to isolate what happened in our housing market during COVID, because as we look back to 2019 or 2018, the statistics for 2022 are more inline to those numbers.

If you’re interested in learning more about what’s happening in the housing market in Waterloo Region, contact me today. I would be happy to sit and have a coffee and chat about how I can help you.

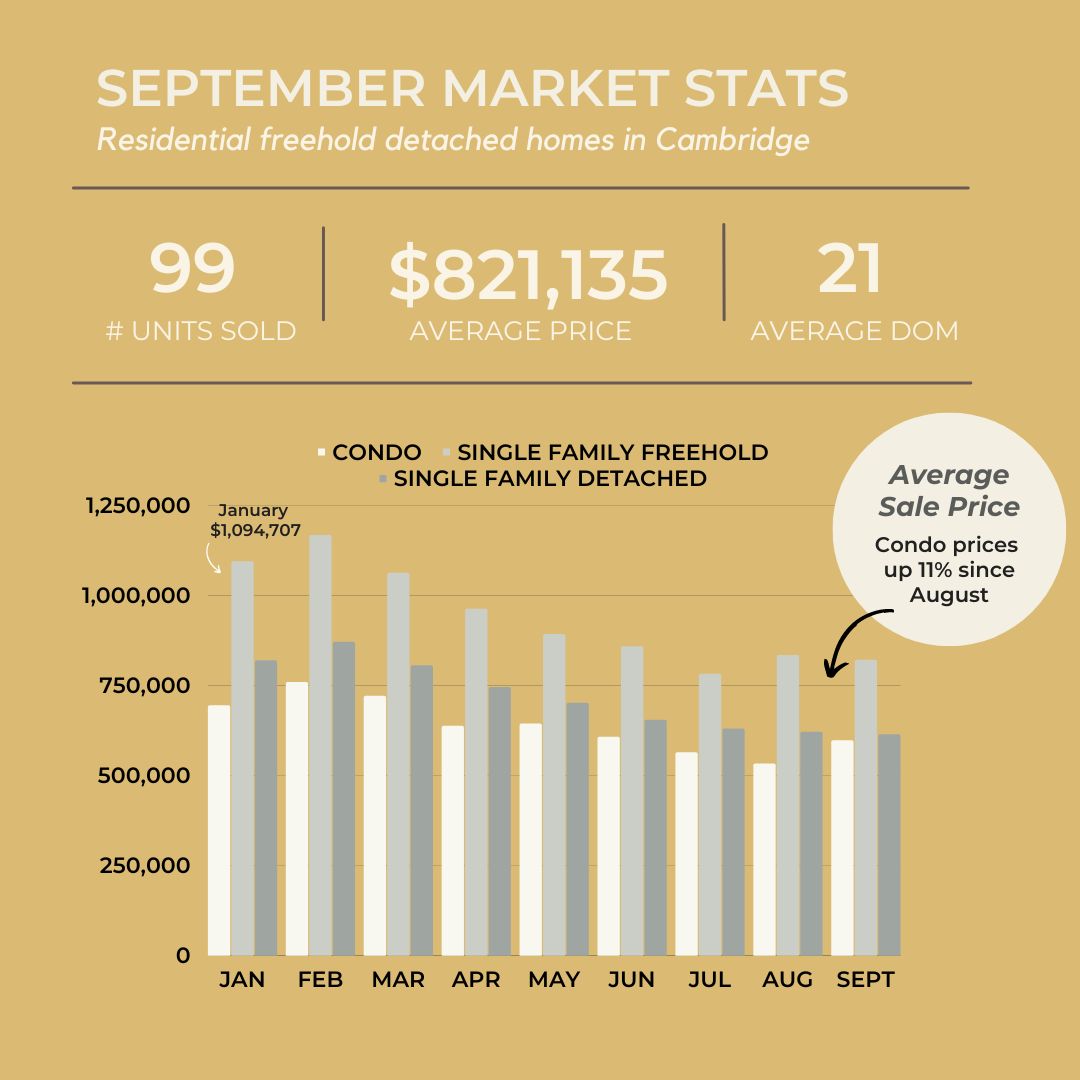

Market Snapshot – September 2022

Oct. 12, 22 | Market Updates

September seemed to have been a little slower in action reporting only 151 sales compared to August which was 184. However, these numbers also reflect the respective month’s new listings which in August saw 275 and then in September a drop to 222. With the decrease in new inventory and the demand still strong the average sale price continues to remain flat, with a 1% drop for Single Family Detached and an 11% increase for condos. Overall, for all home sales in Cambridge the average sale price is shaping up to flatten out which is a good thing.

Consistent with the month over month trend that we have been seeing this year, the price for Residential Freehold Detached homes in Cambridge remains fairly constant. However, we did see a slight increase in sale price for condominiums, jumping 11% since last month, and the question of affordability has become a hot topic.

All this to say, our markets are beginning to show some signs of stability which is much anticipated for both Buyers and Sellers alike. The surging interest rates have driven mortgage payments up, and those in the market to buy subsequently have less purchasing power and Sellers are recognizing this hesitation in Buyers. However, if the trend continues and home prices decline and/or stabilize, we will begin to see some relief for Buyers.

The sharp housing market correction that began this spring is rolling back some of the spectacular price gains made during the pandemic.

Robert Hogue, Assistant Chief Economist, RBC

As we eagerly await the next Bank of Canada announcement coming up this month, we will see and anticipate the impact that decision may have on the markets.

If you want to discuss what’s happening in the market, or maybe the process of buying or selling, I am always ready to have that conversation. All you have to do, is reach out by filling out the form and we can chat more over coffee.

What’s the Deal With Closing Costs?

Oct. 02, 22 | Buying

People often overlook the various expenses they can expect when moving and this can cause some serious stress when something comes up unexpectedly in the buying and selling process. We often calculate our spending budget or our desired sale price, but we don’t take it to the next step and look at what other costs we need to factor in.

Expenses to Expect

Let’s start first with Buyers, and unfortunately Buyers seem to have more items to consider but for good reason. Most of the costs that are incurred are relevant to the purchase of a home. Buyers need to be aware of their pre-approved mortgage limits, but also factor in what their down payment (deposit) will be. Often the deposit comes from funds the Buyer has on hand and can range anywhere from $10,000 up to 10% of the asking price. The deposit is necessary to bind the Agreement of Purchase and Sale, so it is important that these funds are liquid and accessible. Subsequent to your pre-approval, you also need to consider what your down payment will be.

A down payment can be as low as 5% of the value of the home or 20% or greater if you want to avoid mortgage insurance (just another expense to consider that will be paid monthly with your mortgage payment). Buyer’s are also responsible for paying the land transfer tax which varies with the home price.

If we look at the average price of a home in our region of $750,000, the Buyer is looking at paying $11,475 in addition of the purchase price. And if you are a first time home buyer, you can catch a little break on this one assuming you meet the eligibility requirements so be sure to check that out if you think you might be eligible.

A good rule of thumb for calculating closing costs for a Buyer:

1.5% to 4% of the selling price of the house.

Another break that Buyer’s typically get is their Realtor fees which are paid out by the Seller in the majority of cases. If you’re buying a new construction home or For Sale By Owner, have a conversation with your Realtor whether commission fees are applicable to you. Both Buyers and Sellers will be responsible for paying legal fees, and they can vary from $1,000 to $1,500 typically.

Some other closing costs that you could run into:

- Home Inspection

- Property Appraisal

- Property Survey

- Title Insurance

- Status Certificate (Condominium)

- Moving Costs

- Utility hook up fees

- House cleaning

- Appliances & furnishing

Whether you are a Buyer or Seller it is a good idea to be prepared for closing costs irrespective of which side of the transaction you are on. This will help you avoid unpleasant surprises and if you don’t end up using those funds you set aside, considering investing in your next real estate property.

If you want to discuss other expenses to budget for or even what’s happening in the market, I am always ready to have that conversation. All you have to do, is reach out by filling out the form and we can chat more over coffee.

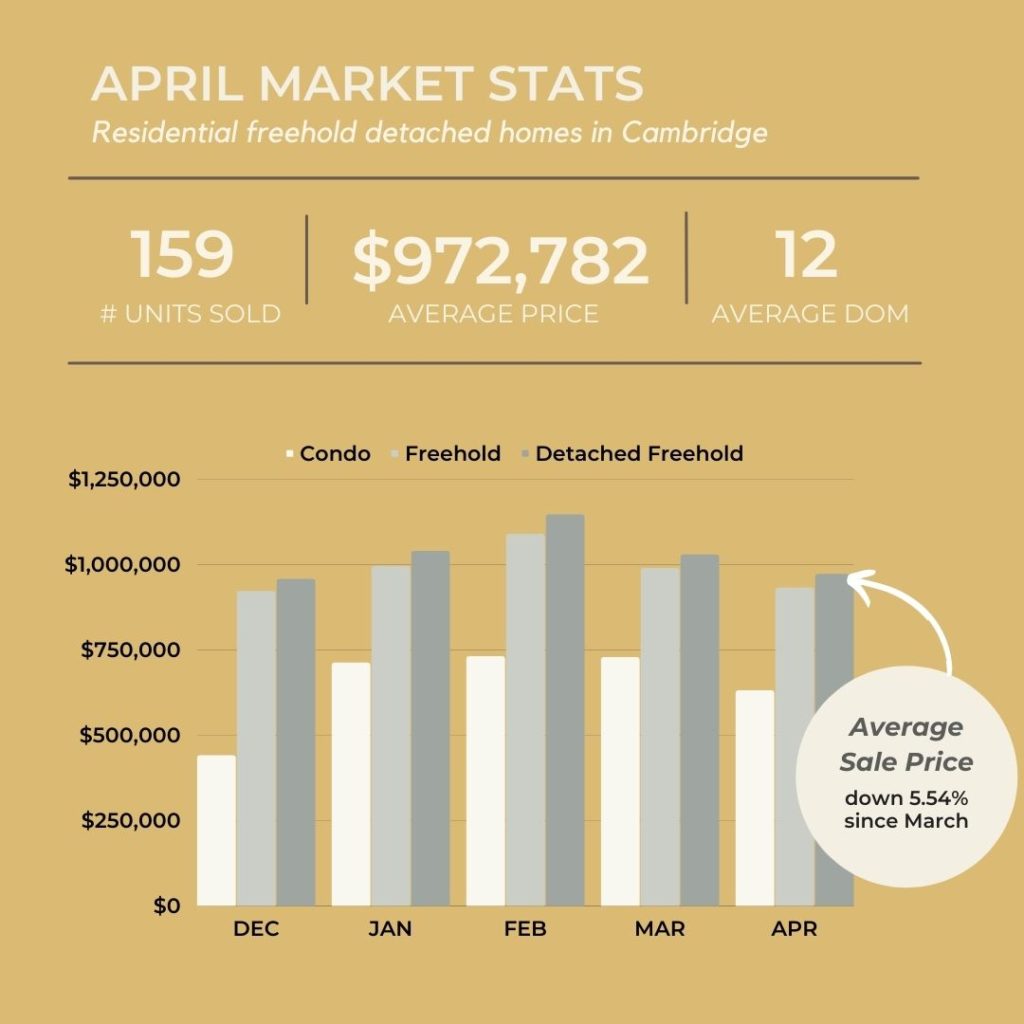

Market Snapshot – April 2022

May. 04, 22 | Market Updates

You know that old saying “April showers bring may flowers”? Well, it wasn’t just rain coming down this last month, it was also the real estate market here in Cambridge.

There were 222 properties sold in April, which is down from March where we had 259 recorded sold properties. What’s interesting about this statistic, is that historically we would be seeing upward trends in the numbers as the spring market typically begins to heat up with more volume and activity. However, these numbers don’t come as a surprise to those with their finger on the pulse, because there has been great intention made by the Bank of Canada to slow things down since inflation was on the rise.

In addition to the decrease in unit sold, there was also a dip in the average sold price, which went from $951,739 in March to $897,913 this April. That’s a decrease of just over 5% on average across all types of properties. To dig a little deeper, both single family-freehold and single family-freehold detached dropped by roughly 5%, it was single family-condo units that were most impacted with a drop in price by just over 13%.

“Moving forward, it will be interesting to see the balance the Bank of Canada strikes between combatting inflation versus stunting economic growth and related government revenues as we continue to recover from and pay for pandemic-related programs.” TREBB President Kevin Crigger

Despite the decrease in numbers, on a year over year outlook, prices are still trending higher then in 2021 by over 20%. So, to put this in perspective, the average price of a single family-freehold detached property in April of 2021 was $814,445, and now it is now $972,782.

Real estate still continues to be one of your most valuable assets, so don’t be discouraged by all the doom and gloom headlines you will read because historically, real estate continues to trend up.

If you want to discuss what’s happening in the market, or maybe the process of buying or selling, I am always ready to have that conversation. All you have to do, is reach out by filling out the form and we can chat more over coffee.

Market Snapshot – March 2022

Apr. 28, 22 | Market Updates

Who would have thought that when we had the March Break that the housing market also got the calendar invite and took a break too, because for the first time in the last four months we saw a dip in sold prices despite the increase in housing inventory.

Cambridge Association of Realtors reported 178 total units sold in March 2022 for single detached homes, which is up from 103 the previous month. This increase to the amount of inventory will directly reflect the average sale price, because as the inventory goes up, buyers are no longer in the same competitive environment they were once in as they now have more selection.

If you want to put this into perspective a little, when we look at the overall properties sold for March 2022 we saw a total of 259 but in March 2021 we had over 400 properties sold. This time last year I can recall news headlines that highlighted a booming market and now one year later, our market continues to be strong. However, with the recent news of rates increasing the news headlines seem more doom and gloom, but the market is anything but that today.

Further to this, and one more point to add before you start to get too worried, is that a one-month dip does NOT indicate that the bubble has popped. Based on historical trends over the last almost 50 plus years we have seen two and now three spikes in the housing market followed by a plateau. So, what we need to consider with the data we analyze in today’s date and time is that our population is the biggest it has been and with anticipation of immigration to add further to this, we will continue to see more buyers than sellers, which will continue to support and drive the prices.

Year over year we have continued to see growth, which is important to keep in perspective.

If you want to discuss what’s happening in the market, or maybe the process of buying or selling, I am always ready to have that conversation. All you have to do, is reach out by filling out the form and we can chat more over coffee.