Author: Christal Moura

What’s Ahead For 2024

Jan. 12, 24 | Market Updates

We have officially closed the chapter on 2023 and as we look back at the real estate landscape in Waterloo Region, we see a tale of deceleration and indecisiveness. So what will this new year bring? Before, I dive into my thoughts about what lies ahead in 2024, let’s take a quick look at what went on this past year.

Quick Review of 2023

Interest Rates:

- In 2022, there were 6 interest rate hikes, and 2 in 2023

- In January 2022, the key rate was 0.25%, and in January 2023, it was 4.5 percent

- By end of 2023, the Bank of Canada held it’s key rate at 5 percent which was set in September

Inventory:

- Yearly New Listings: In 2023, 11,528 new listings were added to the MLS® System, a 14.4% decrease from 2022

- Days to Sell: The average number of days to sell 2023 was 19 days

- Kitchener, Waterloo and Cambridge aimed to start building 5,133 homes last year, but altogether were only able to achieve 56% of the target goal

Impact:

- Annual Sales Declined: The total number of homes sold through the Multiple Listing Service® (MLS®) in 2023 in Waterloo Region witnessed a 14.8% decrease compared to 2022, marking a significant 23.2% decline from the previous 5-year average.

- Average Sale Prices Declined: The average sale price for all residential properties in 2023 was $786,033, a decrease of 7.7% year over year

- Housing continues to be less accessible to too many people in our region, whether it be a lack of inventory, high interest rates or timing, it all impacts the market

The Mindset for the Year

I believe that 2024 holds the potential for a transformative year.

This will be a year of strategizing, a year where you will do your homework, work on establishing good habits and just exercising that muscle and to make the change you desire. I am a big believer in having a growth mindset, but let me be clear, growth can come at different intensities and paces depending on where you are at. So perhaps you have a goal of buying your first home, downsizing or upsizing, whatever goal you have, this year is about what it takes to get you to the final destination.

The Housing Market this Year

For 2024, I see a lot of what we saw in 2023. Last year was a year of testing and recalibrating and then doing that again in an attempt to get to a point of comfort, which we found ourselves in by the end of the year.

Now that we are in a more comfortable position, I feel like this is the year to prepare. In the first half of the year, I anticipate little change to interest rates, demand will pick up in the spring as it typically does and the news outlets will report that “the market is rebounding”. But in the background are 2.2 million homeowners needing to renew very low interest mortgages at almost double the rate. This will hedge the worry that plagues the market and will become the new topic of conversation.

The Bank of Canada already knows if they don’t address the interest rates there will be very costly and consequential impacts, so by the last half of the year I believe rates will start to drop. We have already started to see some lenders advertise promotions of lower rates to incentivize homeowners to renew, thus reducing the impact the lenders have coming with so many renewals to do on the horizon.

Lenders are leveraging a marketing concept known as loss aversion, which targets people who are motivated by the fear of losing something, rather than gaining it. The idea that this promotion is only good right now and I better renew quick because who knows what will happen with the rates next month. This is the kind of thinking that’s happening already and we will see more of it this to come this year. What happens with this sort of thinking though, is that the pessimistic outlook causes consumers to make hasty and irrational decisions. They are motived by fear, and whenever they sense something uncomfortable they want to prevent it from happening. It’s important to talk to a knowledgeable mortgage broker to help you understand your options and who will help set you up for success.

Additionally, as mortgages come up for renewal, homeowners will undoubtedly re-evaluate whether to renew and stay, or move.

Canada currently has a population of over 40 Million, nearly 39% of those people live in Ontario (15,606).

Recent trends have been a migration of Ontarians out of the province, and the loss is balanced by new immigration. Therefore, demand within Ontario will remain consistent year over year. With interest rates anticipated to begin dropping as soon as Q2, we will likely begin to see a lot of market activity. Since inventory is still low, and despite the region coming up short on housing starts, they are continuing to work towards their 2031 goal of 70,000. The lower interest rates will help encourage development and with new motions brought forward by the City of Kitchener and the City of Waterloo to champion the creation of a multiplex zoning bylaw for low-density areas both municipalities may reach their targets.

Final Note: The Pathway to Progress

To quote my Royal LePage CEO and one of Swanepoel Power 200 most powerful and influential leaders, he is dubbing 2024, the year of the “Great Adjustment“. Minor interest rates will fuel the national aggregate home prices and consumers will settle in to the idea of tolerable mid-single-digit borrowing costs.

How I would dub 2024 is the “pathway to progress“. Soper is spot on with the sentiment of adjustment, but what I think he left out is that this adjustment will lead us to a better tomorrow.

So, what’s the purpose of all this progress? It’s to continue to help our communities thrive and grow, it’s to provide basic needs for living, and housing is at the top of the list for me. We are getting there, and that growth mindset I began this piece with, is alive and well – 2024 is the year of the pathway to progress.

Market Snapshot – December 2023

Jan. 08, 24 | Market Updates

It’s the last month of 2023 and yet it’s a similar snapshot of the market from the previous month of November. Sales, inventory and prices were all slowing down as consumers seemingly put a pin in their home ownership goals.

December ended up being a month of slower housing market activity, but likely the shopping online and in stores for holiday gifts and goodies was picking up. The price of a Single Family Detached home dropped from $864,949 to $808,780, that’s a 6.5% drop month over month. For Freehold towns and Semis, the price dropped 3.75% to $632,568 and condos had better news with an increase in average sales price by 9% to $603,282.

What’s interesting to note is that there was a new record low of inventory, but as we know with demand, that hasn’t seemed to let up any.

One would consider this now a Buyer’s Market based on the Annual Sales to New Listings Ratio in Waterloo Region which was 57.7, and a ratio below 60 would qualify it as a Buyer’s Market, where as anything between 60 and 80 is a balanced market and anything above 80 would be considered a Seller’s market. You can see the pendulum has swung significantly since the pandemic when we saw an acute Seller’s market caused by low interest rates, strong demand and low inventory.

Now, interest rates are the highest in 5 years at 5%, but thankfully the Bank of Canada announced no change to rate at their last announcement in December. This also came with another update that inflation has dropped to 3.1% which is essentially right in line with their revised target of 3% at year’s end.

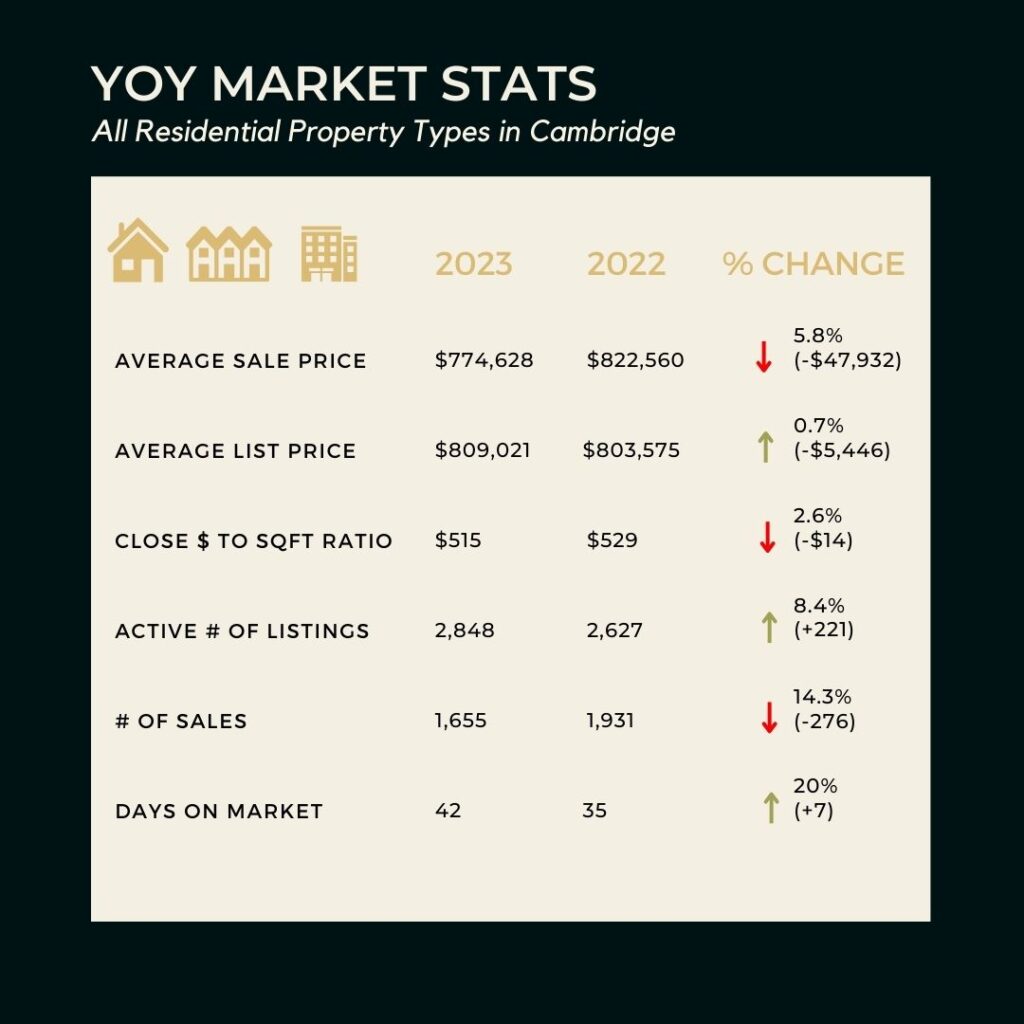

A Look At 2023 Overall

Looking at the year as a whole across all property types compared to 2022 there were some significant changes to note, but much like what we saw from November to December in 2023, the stary year over year isn’t that different.

The last few years we have been fortunate to see an increase in average sale price, but not this year. In fact, this year, there was a 5.8% drop from over $800,000 to just under at $775,000 (rounding up). This is due to the lack of inventory, higher interest rates and uncertain Buyer confidence. The demand is there as our population in Ontario is increasing.

In Q3 2023 there was a 36% increase in population compared to Q3 2022, with a total of 191,418 people immigrating internationally. That’s a considerable jump in our population which will only cause more pressure in the housing market, particularly the homes that are accessible and desirable to the majority of families, which many coin as the “missing middle”.

Thankfully our local governments here in the region are responding to our (Realtors and other advocates) request to help ease the red tape on developing more of the missing middle.

Recently, the City of Kitchener and the City of Water brought forward motions to champion more missing middle housing by asking staff to create a multiplex zoning bylaw for low density areas.

Once developed and active this will allow builders and developers to build a semi instead of a detached single family home, or perhaps a four plex instead of a duplex with out having to go through the rezoning process.

2023 was a year of discomfort for many, whether you were pinching pennies due to the increased cost of living, or maybe even pinching to save a little more for a down payment since the rise in interest rates had you re-evaluating your home purchase budget. I had Sellers press pause on listings as they re-evaluated their current situation, and Buyer’s step back to either change the course and buy something more affordable or wait and save more so they could come back strong for 2024. Whatever your situation was in 2023, I have good news that 2024 is looking like there will be brighter days ahead.

Keep your eye out for my next blog post were I will be making a few predictions of my own on what to expect in the housing market here in Waterloo Region in 2024. In the meantime, keep tracking with me on social media, whether it’s Facebook or Instagram, I’m always posting about what’s happening in the market but also what’s happening in my life as Mom, Wife, Realtor and President of the Waterloo Region Association of Realtors.

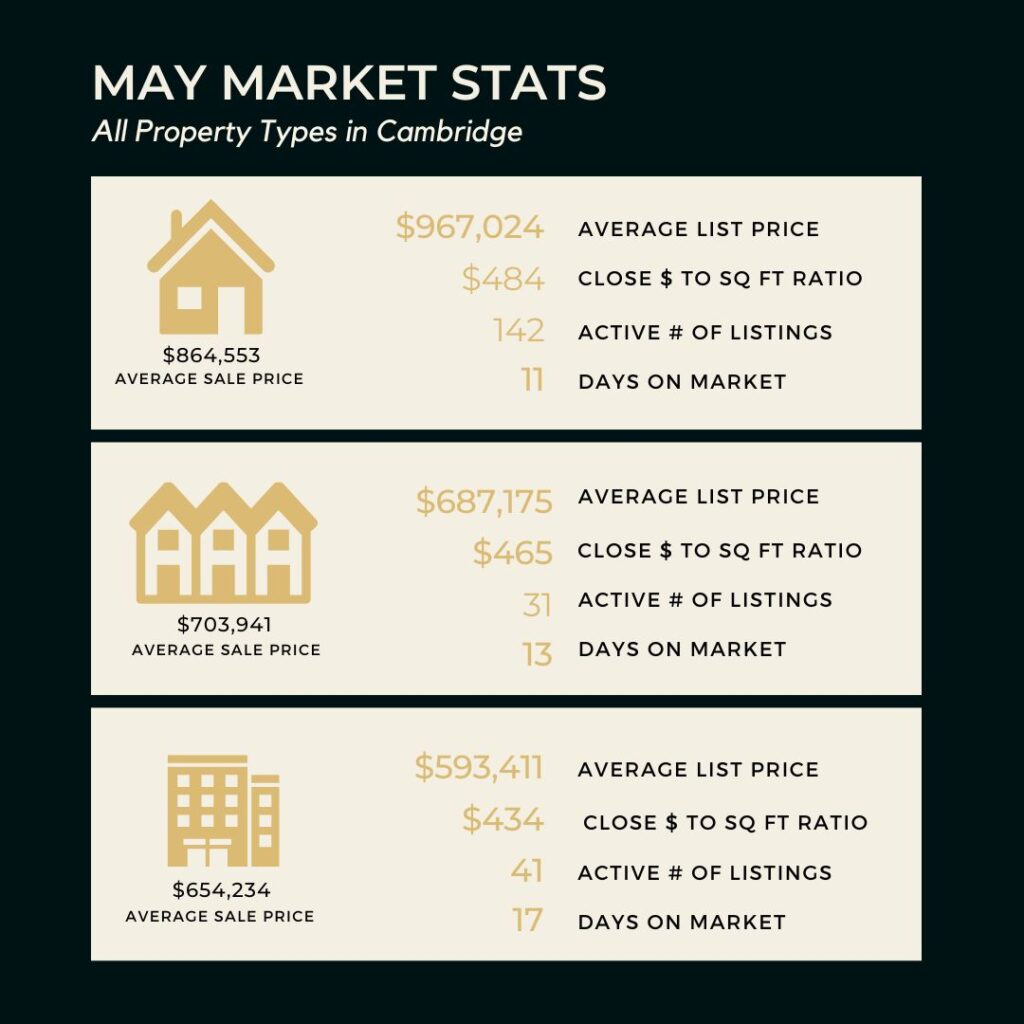

Market Snapshot – May 2023

Jun. 06, 23 | Market Updates

The month of May saw further increases in the sale price of housing which is anticipated to continue as demand is still outpacing supply (inventory). Larry Cerqua, CREA’s 2023-2024 Chair stated that, “over the last few months, there have been signs that housing markets were going to heat back up this year, so it wasn’t a surprise to see things take off after the Easter weekend, which often serves as the opener to the spring market”.

Though the month-over-month increase is not significant enough to plaster all over news outlets, the consistently small increase each month since January is a significant reflection that consumers are feeling more confident in entering the market again. CREA’s Senior Economist, Shaun Cathcart said that “with interest rates at a top, and home prices at a bottom, it wasn’t all that surprising to see buyers jumping off the sidelines and back into the market”. But with supply a little lagging, buyers are finding themselves in competing situations for certain homes. It isn’t the frenzy we saw during the Pandemic, but some homes just have that something that buyers are drawn to and it only takes two buyers to make a competition. That being said, there are also homes sitting longer on the market or accepting offers with conditions, whether it is a condition of finance or even the condition of selling the buyer’s home.

Most residential properties are selling within two weeks and for over asking. We are also noticing though that single-family detached homes listed over $800,000 are often the homes where there is less competition, likely reflective of the higher interest rates. Buyers who were once able to afford these higher price tags when borrowing costs were lower are now finding that their buying power has weakened forcing them to look at homes below that $800,000 mark, which is making the demand for single detached homes between $500K – $800,000 a hot item.

If you want to discuss what’s happening in the market, or maybe the process of buying or selling, I am always ready to have that conversation. All you have to do, is reach out by filling out the form below and we can chat more over coffee. And be sure to follow me on Facebook or Instagram for all the behind the scene and up to the minute news.

3 Days – that’s it?

May. 09, 23 | Market Updates

“Duty of Cooperation”, it might not be trending on mainstream media yet, but it is a hot topic amongst Canadian Realtors®. Last week at the Canadian Real Estate Association’s annual general meeting in Ottawa, delegates from boards and associations across the country voted 83% in favour of adding a new Duty of Cooperation to the Realtor® Code, which is accompanied by a Realtor® Cooperation Policy.

The policy will require listing agents to list properties on MLS® within three (3) days of marketing them publicly, making it an ethical obligation.

The new policy explains public marketing as the representation or marketing of a listing to the public or anyone not directly affiliated with the listing brokerage (office) in a business capacity.

Additionally, the new changes also effect exclusive listings, meaning if a seller does not want their property on MLS®, the listing agent would only be able to market the property exclusively, or more simply stated, on a one-to-one basis and not publicly. That means no for sale sign, no social media posts, no print advertising, and the list goes on. What it does allow is marketing within your brokerage, or to another Realtor® or person on a one-to-one basis.

The revised policy also includes enhanced disclosure and consent requirements between Realtors® and their seller clients. Realtors® will have to disclose to the seller the benefits of listing the seller’s property on an MLS® System, including greater exposure of the property to more potential buyers, which may result in more offers and increase the likelihood of receiving the best offer in terms of price or other terms and conditions of sale.

This all stems as consumers have been becoming increasingly frustrated by the rising misuse of marketing tactics that were keeping listings off MLS® Systems, limiting the exposure of available properties to Realtors® and their buyer and seller clients. It was recognized by the Canadian Real Estate Association (CREA) that there was an imminent issue.

“The increase in the availability of social media highlighted an unfair advantage that some clients were receiving, which prompted us to ensure fair competition in the industry. It is essential that all buyers have equal opportunities to access all listings available for sale and that exclusive listings are used solely for their intended purpose. While there may be rare circumstances where you may not want to make your listing public, such as confidential listings, it’s crucial to maintain transparency and fairness in the industry. Boards and associations brought this issue to our attention since they’re responsible for addressing complaints and enforcing ethical standards among realtors. Through extensive consultation and engagement with our members, we worked to develop a policy that upholds high ethical standards and provides fair competition for all parties involved”. Jill Oudil, Immediate Past Chair of CREA.

The new policy, which will come into effect on January 3, 2024, is focused on the purchase and sale of residential properties, which form the bulk of real estate transactions on MLS® Systems. This timeline will provide real estate boards and associations time to review their current rules and ensure they are compliant with the policy. It will also allow Realtors® time to become familiar with the change and new documentation that is required.

Hopefully, both Realtors® and consumers will become aware and understand the scale and depth that this new change will have. If you have any questions and want to talk about this or anything real estate related, please send me a message or email, I am always happy to help.

market snapshot – april 2023

May. 05, 23 | Market Updates

Demand remains strong as home prices increase month-over-month.

This past month of April turned up the heat in the real estate market, while our actual weather had us scratching our heads and ducking from cover from all the rain.

On a national level, home sales rose 1.4% month-over-month according the Canadian Real Estate Association (CREA). And on a more granular level in the region of Waterloo as a whole added 869 new listings to MLS Systems, of which Cambridge represented 229 of those properties. In total, 670 homes were sold in the Waterloo Region and 175 of those were in Cambridge.

From a month-over-month perspective the statistics are trending upward in a positive direction, but looking year-over-year we are still not were our numbers were last year in 2022, nor are the numbers reflective of the five year average. We should be seeing on average the number of new listings for single family freehold detached homes be around 213 but we are down 21% this past April, and the five year sales average is 138, but in Cambridge in April we only had 111 single family freehold detached homes sold, representing a 24% decrease. Month-over-month we saw a 17% increase in the number of new listings and 23% growth in the number of sales for single family detached homes in Cambridge.

“As the spring market heats up and it looks as though some buyers are coming off the sidelines, it’s important to remember that the intense market conditions of recent years have not gone anywhere, they’ve just been on pause”. Jill Oudil, Chair of CREA

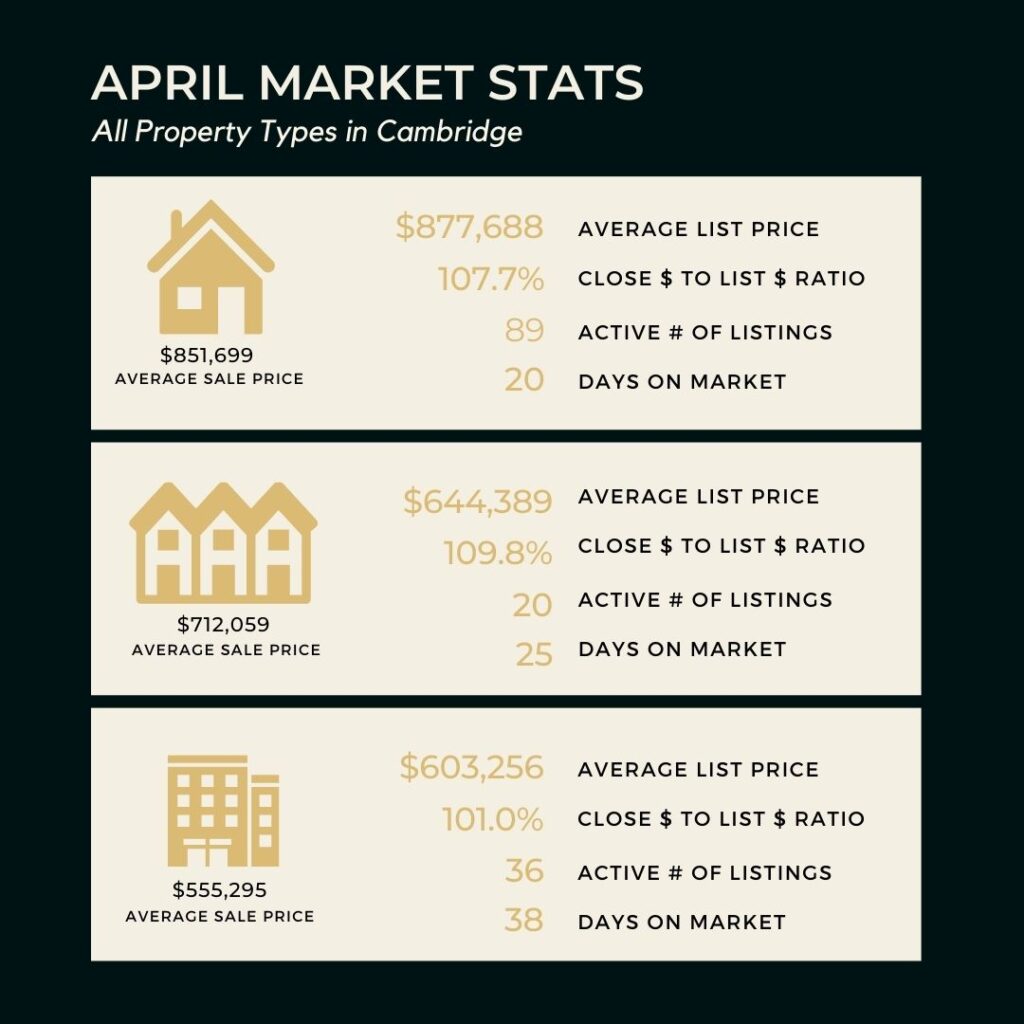

In our region of Waterloo for all property types was $797,716, and specifically in Cambridge $771,965. If we look at the different property types in Cambridge you can see that the missing middle as our industry labels it, so those single family freehold attached homes (semis and towns) are the one property type we are seeing sale prices over asking.

- Freehold attached homes in April were listed on average at $644,389, and sold for $712,059, that’s 10% over asking and it only took over average 25 days to sell

- Freehold detached homes were listing on average around $877,688 and sold 3% less then asking, around $851,699 and took 20 to sell on average

- Condos were listed on average in April at $603,256 and sold less then asking for $555,295 and took roughly 38 days to sell

The surge in activity though expected for this time of year, this upwards pressure on the house prices is largely due to the demand for homes outpacing the supply of new listings coming on the market which has pushed current months of inventory of homes to just one month, which is an unhealthy and unbalanced number. If we don’t see new homes hit the market and sell, I expect the housing market to remain competitive in the month ahead.

If you want to discuss what’s happening in the market, or maybe the process of buying or selling, I am always ready to have that conversation. All you have to do, is reach out by filling out the form below and we can chat more over coffee. And be sure to follow me on Facebook or Instagram for all the behind the scene and up to the minute news.

market Snapshot – March 2023

Apr. 10, 23 | Market Updates

Goodbye winter, hello spring!

Traditionally, this is the time when not only do we start to feel some warmer weather but we also begin to see the real estate market heat up too. Before we get into the housing market let me bring you up to speed a little on the economy which helps give context to the spending habits of buyers and sellers today.

At the beginning of March the Bank of Canada (BoC) decided to hold its target for the overnight rate at 4.5%, with the Bank Rate at 4.75% and deposit rate at 4.5%. We saw inflation ease to 5.9% in January to 5.2% in February, which is one small step closer to the foal of 2% by the end of 2023. What is also interesting to note was just at the end of March details of the 2023 federal budget were unveiled. The intention of the budget is to strengthen the middle class, support an affordable economy and generate a healthy future without heightening inflation. Another noteworthy observation was that the budget did not propose any increases in personal or business tax rates. I say all this to help give some context when we drill down in the housing sector of our economy, and specifically what’s happening here in Cambridge, Ontario.

Sales volume in Cambridge through the Multiple Listing Service® (MLS®) System of the Waterloo Region Association of REALTORS® (WRAR) continues to remain low. In March for all of Waterloo Region there were 611 homes sold in March, representing a decrease of 38.4 per cent compared to March 2022 and 33.6 per cent below the previous 5-year average for the month.

Looking closer to home, in Cambridge there were 188 new listings and 153 listings sold. We are looking at just one months supply of inventory. In fact, what we are seeing is demand exceeding inventory, currently a deficit in homes compared to buyers. The drop in inventory becomes staggeringly apparent when we look at the ten year average and begin to see that historically new listings for residential properties in Cambridge are around 300 in March but are now almost half that. Number of sales is also proportional, with the ten year average being around 227 and now 153.

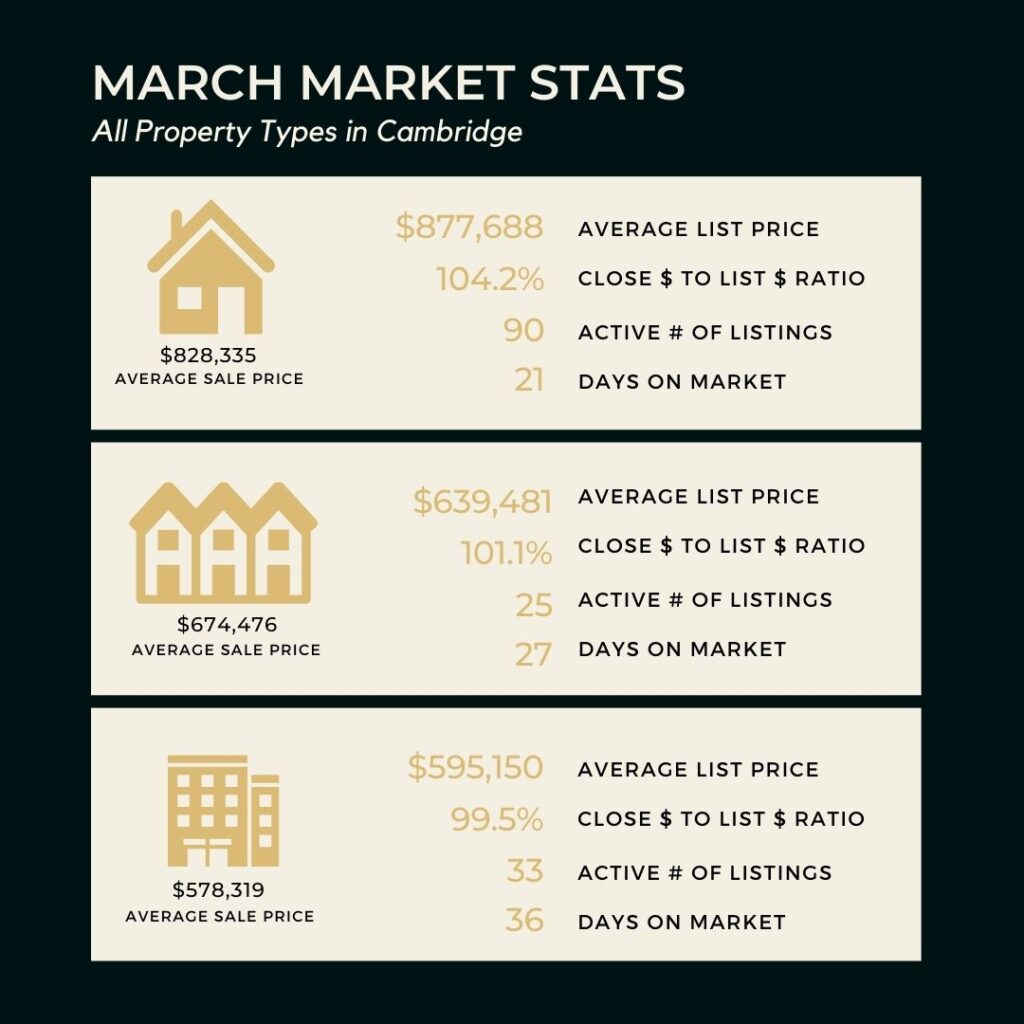

There continues to be relatively consistent average sale prices for properties in Cambridge. For all property types in Cambridge the average list price is $775,613 and average sale price being $733,236. That means that on average in March we are seeing a 5% difference in average list price to sale price.

If we look a little closer at the specific property types, a single family detached home in March was listed on average at $877,688 and sold 5% less then asking. If you are wondering the difference in price between a single family detached home and attached home (semi or townhouse), there is an 18% difference in the average sale price. A single family attached property sold on average for $674,476 in March here in Cambridge. And, condos in Cambridge sold on average for 16% less then an attached home, $578,319, but remember these properties even though the sale sticker is lower, your monthly expenses can work out to be roughly the same as attached freehold, since there are condo fees to account for.

If you want to discuss what’s happening in the market, or maybe the process of buying or selling, I am always ready to have that conversation. All you have to do, is reach out by filling out the form below and we can chat more over coffee. And be sure to follow me on Facebook or Instagram for all the behind the scene and up to the minute news.

Five Simple Staging Tips To Sell Your Home

Mar. 30, 23 | Homeowners

If you made it to this point, I think it’s safe to say that I don’t need to convince you that staging works. Not only does staging improve the sale price of your home by up to 20% but it also proven to sell a home up to 11 times quicker than those that aren’t staged. So, I think you get the drift that staging works.

But, what is home staging really?

To keep it simple, home staging is the act of preparing your home for selling – staging your home to look as if someone lives there so that the potential buyer(s) can more easily see themselves living in that space. There are varying degrees of staging from just adding accessories or on the other end of the spectrum, painting the walls, changing light fixtures, and bringing in furniture that suits the room. For the purposes of this post, I am going to give you the quickest, simplest and most wallet friendly tips, because if you’re not doing atleast these five things when selling your home, you’re leaving money in the pockets of the buyers instead of padding yours.

Tip # 1 – Artwork

Artwork can fill an otherwise bare wall, which can be good or bad depending on the piece. The key to artwork when staging, is to pick pieces that are neutral in imagery, so think landscapes, abstract or natural elements. The colours and tones of the piece also play into setting the ambience of the room. So for example, a soft white or neutral piece like this sail boat evokes a peacefulness and calmness. This subtle messaging is not just applicable to the artwork but also to the audience who is suddenly transported to feel those same feelings when in the space.

Tip # 2 – Greenery

Natural elements such as fresh cut flowers, or stems in a decorative vase can easily bring the outside in, as well as add an interesting focal point for the eye to wander to. The wonderful thing about greenery as well, as it can add height to a space which makes people feel like there in a larger room then it may appear because your eye is drawn up.

Another tip when thinking about greenery, is don’t feel limited to putting it in your traditional spaces like the kitchen or dining room. Consider putting out a small bud vase with a fresh cut flower in the bathroom next to the soap and hand towel, or what about hanging a sweet bouquet of dried eucalyptus from your shower head with a pretty ribbon. Not only is it beautiful, but the fragrance will draw you in and make you stay longer.

Tip # 3 – Lighting

Natural light is always the best kind of light, but this becomes a problem in the evening which is when most Buyers go to look at a property. It’s critical that you have sufficient lighting in a room when selling a house. And I don’t mean just one light in a room so you can see where you’re going, I am talking about ceiling lights as well as accent lighting like table or floor lamps. When placed well a beautiful light can act not only as a decorative piece of art, but also literally casts light on the places we want our Buyers to see. Think about it, in your bedroom there are often table lamps for function, but the light shines up through the lamp shade drawing the eyes to the ceiling which emphasizes the height of the room. Or maybe you place a floor lamp in a corner next to a couch or hutch, the Buyer’s eye is drawn to the outer corner of the room highlighting the spaciousness of the room.

Tip # 4 – Closets & Cupboards

Assume that all closed doors are fair game, that is, they will be opened. This includes your bedroom closets, linen cabinet and even kitchen cupboards or pantry. While having the space looking magazine worthy, it is important that you tidy up the items and remove ones that you may not want people to see. This could be a time consuming tip, but it doesn’t have to cost you a dime, and psychologically, as Buyers look in your home and see tidy and well kept spaces they equate that to you having pride of home ownership. This basically means, that if you care about a tidy sock drawer, you must also care about other items like the roof or furnace of the home too.

Tip # 5 – Table Setting

Setting the kitchen or dining room table is an easy and cheap way to dress up the space. It is also is an opportunity for you to take a rather boring table and add a splash of colour or interest with the napkins or plate chargers. The trick though when staging the table, is to keep it simple. If your plates have a pattern on them, then make sure the napkin and placemats are plain and simple, but if you have white plates, add some colour or a pattern with the napkins or table runner. Another bonus tip here, is don’t just think inside the box, or rather house here. If you have your patio table out, why not dress it up too, just make sure the napkins don’t fly away.

I hope these tips help make staging your home easy and impress future buyers. Adding in decorative elements should make your home feel more complete, the only thing missing is the new home owners. If you are thinking about selling your home now or maybe in the next few years, now is the time to start thinking about the return on your investment.

Contact me today if you want to make sure that you are making the right choices that will make you the most amount of money when selling your home. What you do today, matters for your tomorrow.

Market Snapshot – February 2023

Mar. 07, 23 | Market Updates

Weakening housing trends remain the central theme early in 2023 across Canada.

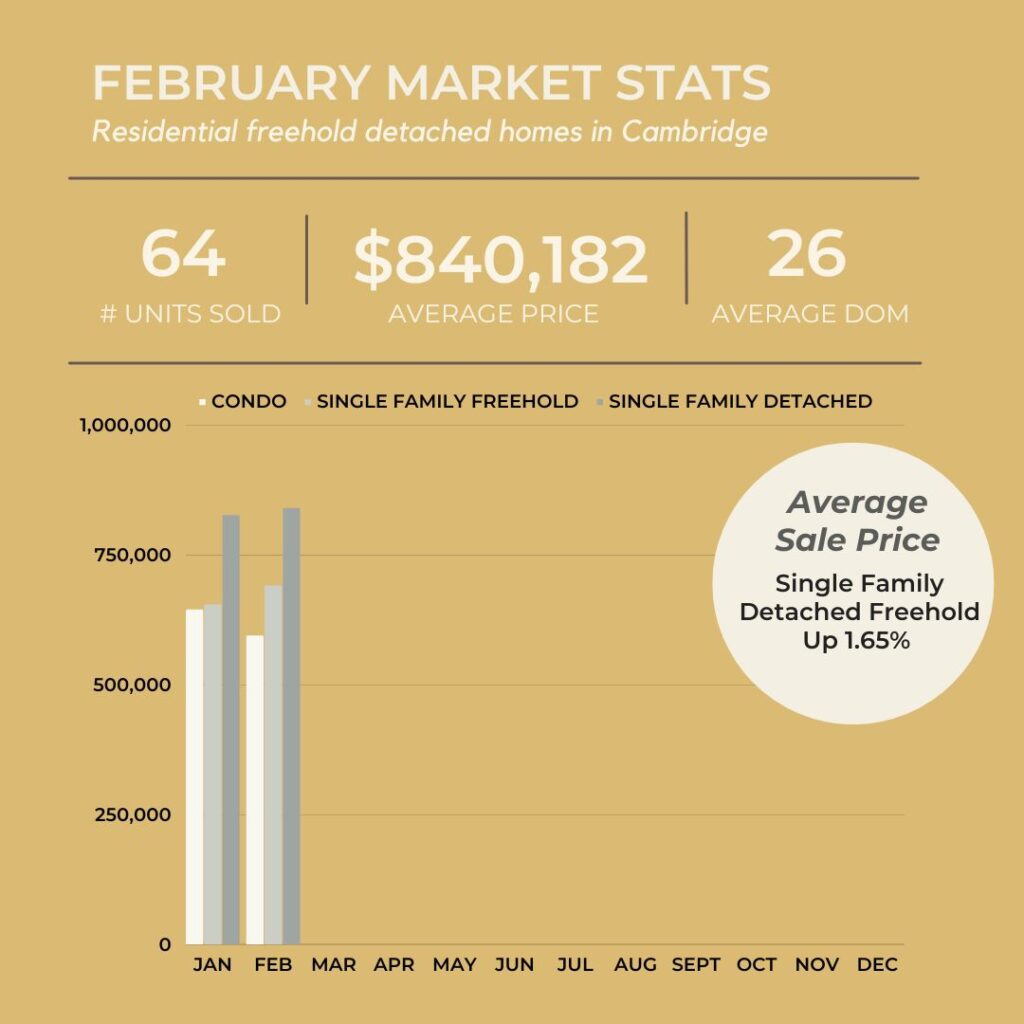

There was a decrease to all residential home sales in the City of Cambridge in February compared to the previous month, prices dropped nearly 4% overall. However, from all properties sales, those most affected were condos, and single family detached homes saw a increase, be it very minor, an increase is an increase. Single family detached homes, went up 1.7% ($840,182), from January when the price was roughly $14,000 less.

Market Snapshot – January 2023

Feb. 02, 23 | Market Updates

One month into the new year and we are already seeing signs of a strong housing market in our city of Cambridge, Ontario.

Last year, in January there were high housing prices due to low interest rates, low inventory, high demand and fewer barriers to entry. By year end things had changed dramatically, closing the year out with the least amount of new listings for the month (88, high of 410 in April), as well as least numbers of sales (72, high of 249 in March). So, when I say the year started out strong with home prices hovering around a million dollars, and then being in the low 700,000s by year end, would be an understatement. *(These numbers reflect all residential homes in Cambridge as per ITSO. InfoSparks © 2022/2023 ShowingTime).

However, if you were to look at the year without comparing it to other years you would be left scratching your head as to why the dramatic shift. You would have to go back a few years to start to unpack this and first look to a growing population (demand) and a lack of housing (supply). This unbalanced market only heightened as borrowing costs continue to dip making it easier to justify going into debt, as the appreciation would outweigh the low carrying costs.

Everything seemed hunky dory until people started noticing our inflation rate, which simply stated is a rise in prices which results in the decline of purchasing power. So, as people began spending during the pandemic the inflation rate continued to rise and it became apparent that there could be detrimental ramifications if not addressed.

This is the part in the story that the Bank of Canada comes into flex their muscles and save the day. In order to squash the hemorrhaging wallets of Canadians, something needed to be done, so those low interest rates we loved so much began to rise. Slowly throughout the year marginal increases were made to the rate which took time to actually be reflected in Canadian’s spending habits. So, as we enter a new year with interest rates higher then this time last year, we also see a change in the housing market.

No longer are prices close or over a million dollars for a single detached home in Cambridge, they are now just over $800,000. We are still in short supply of new inventory but demand is still there, people are now more cautious about over spending and are selective in what they spend their money one.

As we look ahead, I think many people are apprehensive to share their thoughts on what the housing market will look like in 2023. But as a Realtor® it’s my job to study and know the market, to keep my finger on the pulse and to be informed with monetary policy, mortgage rates and the economy. I tend to share a similar sentiment as the recent 2023 Royal LePage Market Survey Forecast. highlighted, and that is that though we have seen a drop in prices, a rise in interest rates, we still continue to have a shortage of homes to meet the needs of our communities. I expect that 2023, though it won’t be as extreme as the height of the pandemic, I do expect we will continue to hear a similar story.

If you want to discuss what’s happening in the market, or maybe the process of buying or selling, I am always ready to have that conversation. All you have to do, is reach out by filling out the form below and we can chat more over coffee. And be sure to follow me on Facebook or Instagram for all the behind the scene and up to the minute news.