Market Snaphot – November 2022

Dec. 09, 22 | Market Updates

If I didn’t know that I was looking at the November 2022 stats, I would have thought it was November 2019. Reason I say that, is that the market is coming back to a more balanced state like we saw prior to COVID. Unfortunately, the boom of the housing market these past few years has clouded our memories of what a “normal” housing market looks like. We are so used to low interest rate, high demand and even higher sales prices, that we have forgotten about how a healthy and stable, or dare I say normal housing market looks like.

Sure we saw another hike to interest rates that continued to slow down buyers, but these increases to the prime rate that the Bank of Canada is making is having the exact effect that they are hoping to achieve, and that is to reduce inflation. It’s no surprise that the higher interest rates have definitely slowed down the intensity of the market, but it hasn’t stopped it completely. Remember, there will always be situations where people have to buy and/or sell, such as a job relocation, outgrowing their home, marriages or divorces. There are a variety of life circumstances that we just can’t avoid; delay, yes, but avoid not forever.

Inventory was low in November, with a total of 132 new listings in the City of Cambridge added and there were 96 total sales. This equates to roughly one month of inventory, or also know as MSI (month supply of inventory), which reflects the relationship between supply and demand. So, looking at November theoretically it would take one month to burn through all the homes currently available, so if no new listings were added, Buyers would be left without any options. The interesting element to note about the number of new listings and sales, is that these totals look very similar to what a five year average would have looked like prior to COVID. An average amount of new listings would have been around 125, and 115 sales, so in actuality, November 2022 is very healthy and balanced.

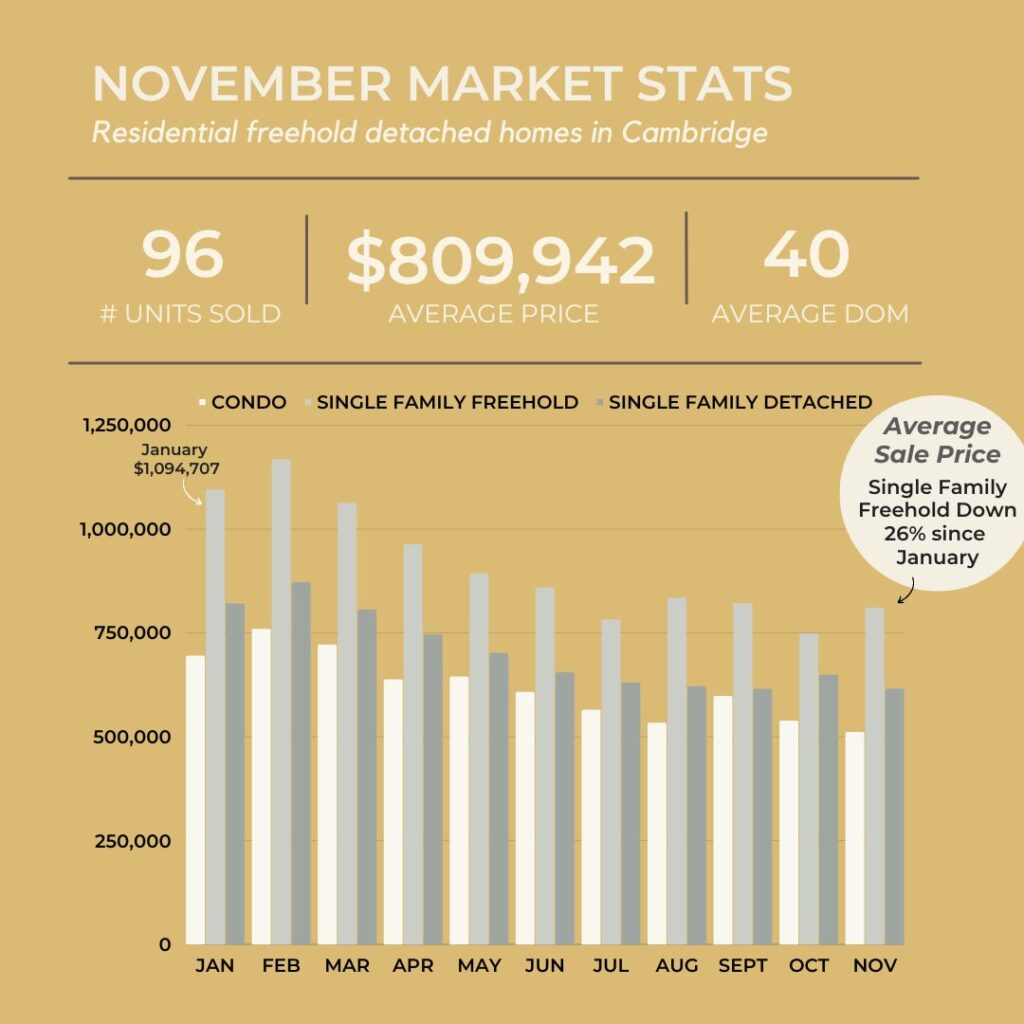

What may not be similar to the five year average prior to COVID, is the sale prices. In fact, the sale price for a single family detached home in November isn’t even remotely close to what is what at the beginning of the year. In January of 2022, the average sale price was sitting just above one million dollars ($1,094,707) and now eleven months later, that same house would sell for 26% less, closer to $800,000 and it would take over a month to sell, whereas in January it would have been about a week to two weeks.

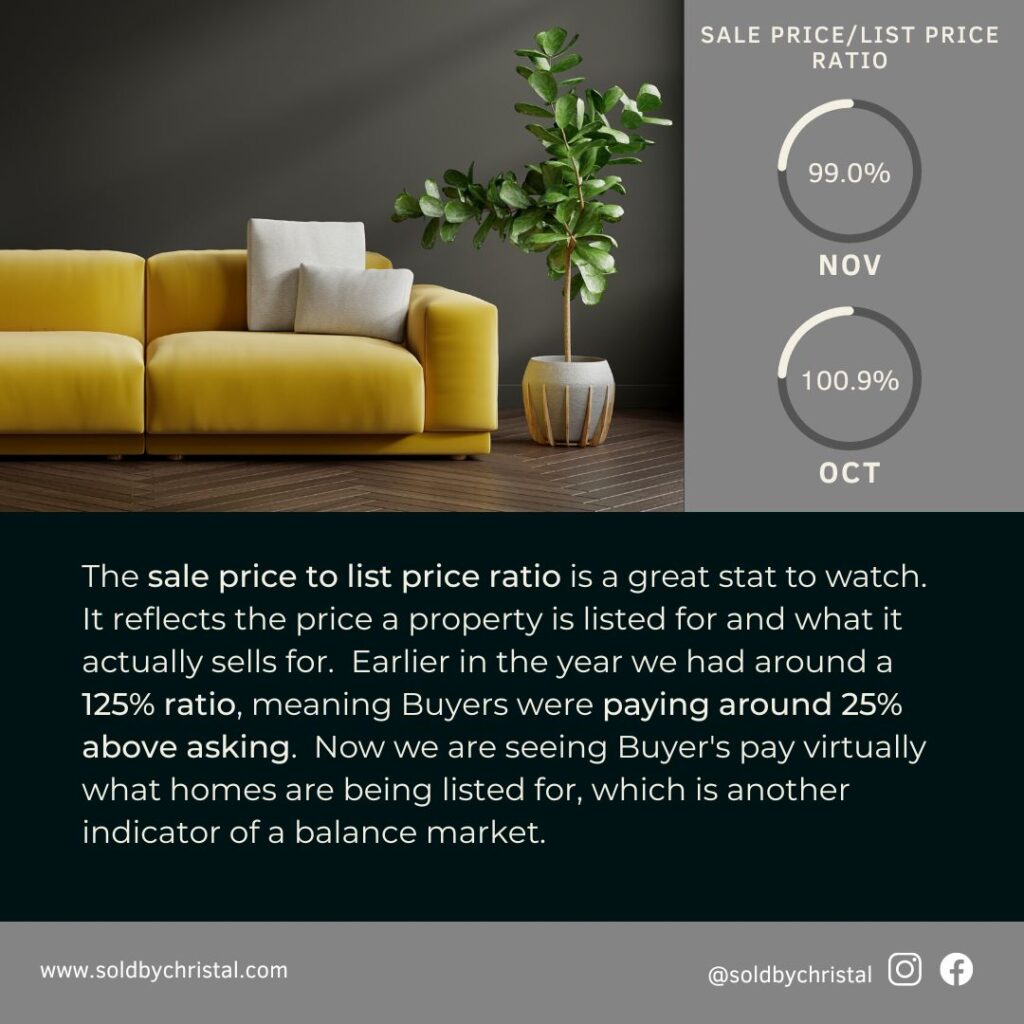

Since there are fewer Buyers due to the rising interest rates and speculated economic uncertainty, demand has dropped. Houses that are being listed are selling closer to their asking value, and there is a smarter pace at which a Buyer takes to purchase a property. We have time once again to have finance and inspection conditions in our offers, which affords the Buyer the ability to make sure that the purchase that they are about to make is right for them. They can truly crunch the numbers, investigate all possible scenarios that they could encounter if yet another rate increase, or if they have a to replace an expensive aspect for their home unexpectedly.

Sure, the housing market these past two years made for better headlines in the news, but a more balanced market is more fair for both parties. Now is a great time to buy or sell, and if your curious to hear more, or discuss how I can help you with your real estate needs, whether buying, selling or investing I would be happy to have a coffee and chat with you all about it.